Business Insurance in and around Somerset

Somerset! Look no further for small business insurance.

Insure your business, intentionally

Business Insurance At A Great Value!

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or accident. And you also want to care for any staff and customers who become injured on your property.

Somerset! Look no further for small business insurance.

Insure your business, intentionally

Keep Your Business Secure

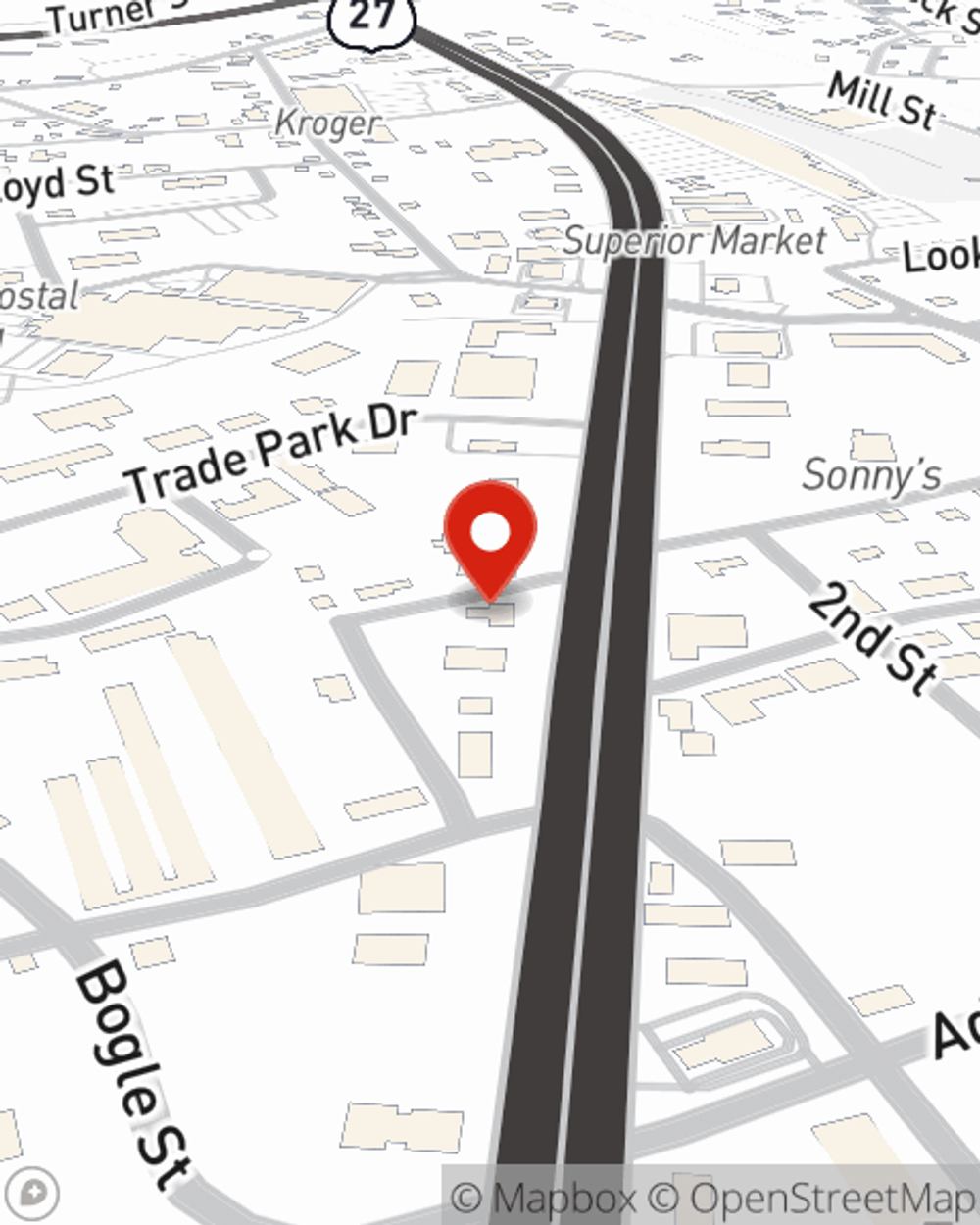

With options like business continuity plans, worker's compensation for your employees, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Chad Smallwood is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Take the next step of preparation and visit State Farm agent Chad Smallwood's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Chad Smallwood

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.